A CAUTIONARY purchaser temper continues to influence the agricultural property market throughout the japanese seaboard.

On this week’s property assessment, agribusiness and rural valuation specialists in Queensland, New South Wales and Victoria share their views on the state of the market, on a region-by-region foundation.

Queensland

Well-known valuer Roger Hill is the North Queensland regional director at Preston Rowe Paterson.

Roger Hill, PRP

He mentioned the latest fluctuations within the cattle market had served to alter the due diligence course of amongst Queensland cattle property purchasers.

“The latest restoration within the cattle market has been good for bringing consumers again into the property market, however with a extra thought-about and prudent strategy to their pricing course of,” he mentioned.

Mr Hill notes cattle market actions within the latest month and 12 months have had a optimistic affect on purchaser curiosity.

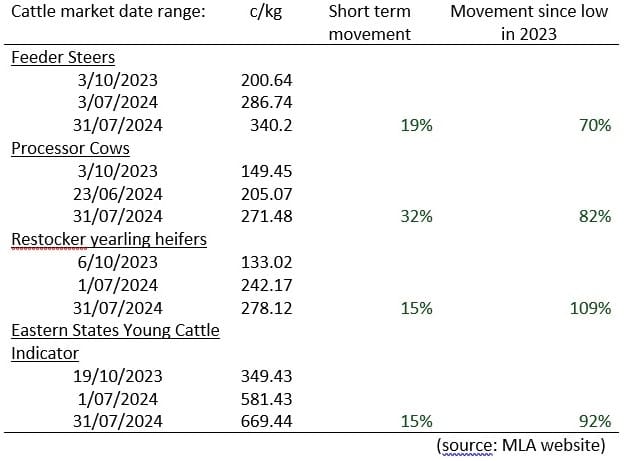

The desk under critiques the MLA knowledge for the brief (final month) and longer (since about October/November final 12 months) value actions.

Distinction between breeding and ending/backgrounding nation

Regardless of optimistic cattle market actions, over the past 12 months Mr Hill has witnessed a break up within the property market due diligence course of – between breeding and backgrounding nation.

“For backgrounding and ending nation, consumers are nonetheless speaking tough property worth gauges of {dollars} per hectare or beast space values. In these market areas there’s sturdy demand for nation and market situations are akin to a sellers’ market,” he mentioned.

“The market is displaying confidence on this part of the provision chain to be worthwhile at present (and probably barely increased) property worth parameters.”

Mr Hill mentioned within the final 12 months, market situations had modified for breeding nation.

“Consumers are doing their figures, operating inventory flows, cashflow and capital growth budgets,” he mentioned.

“Sure, these processes are being adopted in backgrounding nation, nevertheless in forest breeding nation, consumers seem like extra stringent of their strategy and matter of reality, somewhat than accepting of rule of thumb guides,” he mentioned.

Based on Mr Hill, the mix of upper working prices, increased curiosity payments and decrease (or fluctuating) cattle costs are foremost in consumers’ minds.

He believes the northern breeding cattle property market section is properly and really within the consumers’ favour.

“Merely speaking of a value per hectare or beast space is useful as a worth proposition, nevertheless if there’s a property market sentiment change within the wind, then working value profiles and money circulation returns are beneath the highlight in attempting enterprise situations.”

Mr Hill mentioned there was solely a specific amount of debt and web return that an enterprise can service.

In latest months, in keeping with the cattle market restoration, he mentioned there have been indicators of stronger demand for backgrounding nation.

“In some districts, worth parameters are just like 2023, whereas these in the direction of the north and north-western areas of Queensland are displaying indicators of demand barely pushing costs up.”

Mr Hill mentioned there are some personal offers being negotiated off market, nevertheless no properties had been being listed and supplied to the open market.

“Market situations are tight attributable to sturdy demand. Within the forest breeding section, there are eight stations available on the market within the north at current.”

Brennan Leggett PRP

“For positive, there’s good market curiosity, but the calculations are actually being carried out at these working margins,” he mentioned.

In relation to North Queensland’s coastal grazing property markets, PRP valuer and analyst Brennan Leggett stories Bowen, Ingham, Tully and Innisfail have remained comparatively secure all through 2024.

“There are indicators of some strengthening in land values totally on the again of commodity value efficiency and a levelling in rate of interest rises,” Mr Leggett mentioned.

New South Wales

James Skuthorp oversees Dubbo and the Central West for valuers PRP. He mentioned throughout many of the state, the property market had stabilised with purchaser warning now obvious.

“After a decade of unbroken farmland worth progress, consumers have change into extra thought-about of their buying selections following important shifts within the working surroundings,” he mentioned.

James Skuthorp PRP

Mr Skuthorp mentioned throughout the broader a part of New South Wales, late 2022 to early 2023 seems to have been the market peak, with a big improve within the variety of gross sales supported by sturdy sale outcomes.

“2023 was a vastly completely different 12 months for Australian agriculture as drier situations, falling commodity costs, sustained excessive value of key farm inputs and sustained excessive rates of interest contributed to a cooling-off in demand for farmland which in flip had a softening impact on property values,” he mentioned.

For a lot of rural enterprises, the numerous drop in cattle costs proved to be the strongest headwind on money circulation.

“This was compounded by the components talked about beforehand and made it more difficult for potential consumers to safe funds.”

Mr Skuthorp mentioned with the important thing drivers of farmland values set to stay in a holding sample in 2024, it was seemingly the market will see a plateau in values.

“The continued discount in confidence in rural grazing properties within the Central West, Far West, Riverina, New England and North West in comparison with 2022 is most evidently expressed by the latest collapse within the cattle market,” he mentioned.

“Present market costs for beef are returning nearer to ranges extra typical of long-term averages, notably since seasonal situations improved from November 2023, nevertheless we’re not seeing a shift in elevated purchaser exercise for rural grazing property so far.”

Mr Skuthorp mentioned a number of components had been contributing to the warning.

“The latest collapse in cattle costs continues to be recent, international provide points have created inflationary headwinds which has resulted in increased working prices, and producers proceed to expertise the next rate of interest surroundings.”

Victoria

Larry Harden is a senior valuer and accomplice at PRP Geelong and Warrnambool in Victoria, and Mount Gambier in South Australia.

Larry Harden PRP

He mentioned the grazing property market in Western Victoria was experiencing a interval of adjustment.

“It’s a notable shift from the speedy progress and excessive exercise that started in 2015 and continued till early 2023, to a extra subdued surroundings in 2024.”

Mr Harden mentioned increased rates of interest, softer beef costs, rising enter prices and a dry autumn had mixed to sluggish market exercise and cut back property values.

“Consumers are extra selective, and transactions are more and more influenced by native dynamics and if operational efficiencies may be achieved by buying adjoining or close by land.”

He outlined a few of the key components which have influenced the property market:

- The upper rate of interest surroundings has elevated the price of borrowing, impacting on a farmer’s capacity to finance new purchases, increase operations or spend capital to enhance infrastructure on present holdings.

- Softer beef commodity costs on the again of a downturn within the beef trade. The Jap Younger Cattle Indicator peaked at 1154c/kg carcase weight in January 2022 however fell sharply to 358c/kg by September 2023. At present the EYCI is at 672c/kg, which continues to be barely under the long-term common, however trending upwards.

- Elevated prices for inputs corresponding to feed, gasoline, fertiliser and labour have resulted in increased manufacturing prices impacting on farmers’ backside line.

- Dry situations for the primary six months of 2024. Many elements of Western Victoria have skilled a ‘inexperienced drought’ the place good rainfall was acquired in January and minimal falls from January by to June. This has resulted in a late autumn break and lowered autumn/winter pasture manufacturing. Because of this, extra fodder was bought by many farmers inserting additional stress on cashflows, as costs for fodder elevated attributable to demand.

Mr Harden mentioned market tendencies noticed by the primary half of 2024 included:

- The earlier property increase noticed an inflow of consumers (together with established operators) looking for to diversify into various agricultural pursuits to unfold danger. Nevertheless, because of the present market situations and micro and macro-economic influences, consumers have change into cautious. Transactions are actually extra more likely to contain neighbouring property house owners who can leverage managerial efficiencies by buying adjoining or close by land.

- A softening in worth for grazing land with property values on a gradual decline since early 2023. This displays the lowered demand and elevated market stress from increased rates of interest, increased enter prices and decrease commodity costs.

- Longer promoting intervals. Properties are typically taking longer to promote except distributors modify their expectations to align with the present market situations. The slower market is characterised by fewer transactions and longer negotiation and promoting intervals for due diligence and securing of finance, with financing changing into tighter.

Mr Harden mentioned whereas the general grazing market had cooled, there have been nonetheless pockets of exercise in some areas, notably the place native situations or particular purchaser pursuits create alternatives.

“That is presently being noticed in areas appropriate for agroforestry the place a variety of each grazing and dairy properties have been bought to corporations that are changing the acquired land into hardwood and softwood plantations.”

Mr Harden mentioned this development was primarily pushed by the extra worth generated by the manufacturing of carbon credit, which have change into a beautiful incentive within the present market.

“The demand for carbon credit has surged as corporations and governments search to satisfy environmental and sustainability targets, making the institution of plantations on former grazing land a financially viable and strategic funding for these forestry enterprises,” he mentioned.

Trending Merchandise